Industrial Natural Gas Procurement Services

Services for Industrial Facilities.

As per the EIA Report:

(For the week ending Wednesday, October 1, 2025)

Henry Hub spot price: The Henry Hub spot price rose 36 cents from $2.88 per million British thermal units (MMBtu) last Wednesday to $3.24/MMBtu yesterday.

Henry Hub futures price: The October 2025 NYMEX contract expired Friday at $2.835/MMBtu, down 2 cents from last Wednesday. The November 2025 NYMEX contract price increased to $3.476/MMBtu, up 34 cents from last Wednesday to yesterday. The price of the 12-month strip averaging November 2025 through October 2026 futures contracts climbed 22 cents to $3.898/MMBtu.

In January 2025, dry natural gas production increased year over year for the second consecutive month. Preliminary dry natural gas production in January 2025 was 3,228 billion cubic feet (Bcf), or 104.1 billion cubic feet per day (Bcf/d). Production was 0.6% (0.6 Bcf/d) higher in January 2025 than in January 2024 (103.5 Bcf/d). Dry gas production was the highest for the month since 1973, the earliest year in this data set.

Let The Wasmer Company help you with this.

Schedule a Free Consultation

to Talk to an Energy Specialist!

Already in a contract? We can still help you prepare for renewal or evaluate mid-term adjustments**

**Please Note: Our services are exclusively for industrial properties. We do not offer residential or commercial services. Thank you for your interest!

Strategic Energy Solutions That Reduce Risk and Maximize Savings.

At The Wasmer Company, we specialize exclusively in serving industrial businesses with strategic energy procurement solutions. We do not provide services for residential customers. Our deep industry expertise allows us to create customized natural gas and electricity procurement strategies designed specifically for large-scale industrial operations. Whether you need the budget certainty of fixed pricing or the adaptability of index-based models, we align our solutions with your operational demands, risk profile, and financial goals.

Whether your facility consumes energy for manufacturing, heating, or process-intensive operations, we help you navigate complexity, manage price volatility, and secure energy with confidence.

—Especially for Natural Gas.

Natural gas plays a vital role in industrial operations—from powering boilers and heating systems to serving as feedstock in chemical and food manufacturing. But gas prices are tied to a volatile physical market, where factors like:

- Seasonal demand shifts

- LNG exports

- Pipeline constraints

- Regional basis differentials

- Weather events and storage levels

All contribute to unpredictable costs.

Electricity markets are similarly impacted by regulatory structures, infrastructure, and renewable adoption. But natural gas is uniquely exposed to NYMEX futures pricing and regional basis volatility, making a smart procurement strategy essential.

Wasmer helps you:

✔ Analyze your current natural gas and electric usage

✔ Understand and hedge NYMEX and basis exposure

✔ Choose between index-based, fixed, or hybrid strategies

✔ Mitigate risk with contract terms that fit your operations

✔ Optimize spend while maintaining reliability

In today’s market, energy procurement isn’t just about lowering your bill—it’s about building energy resilience.

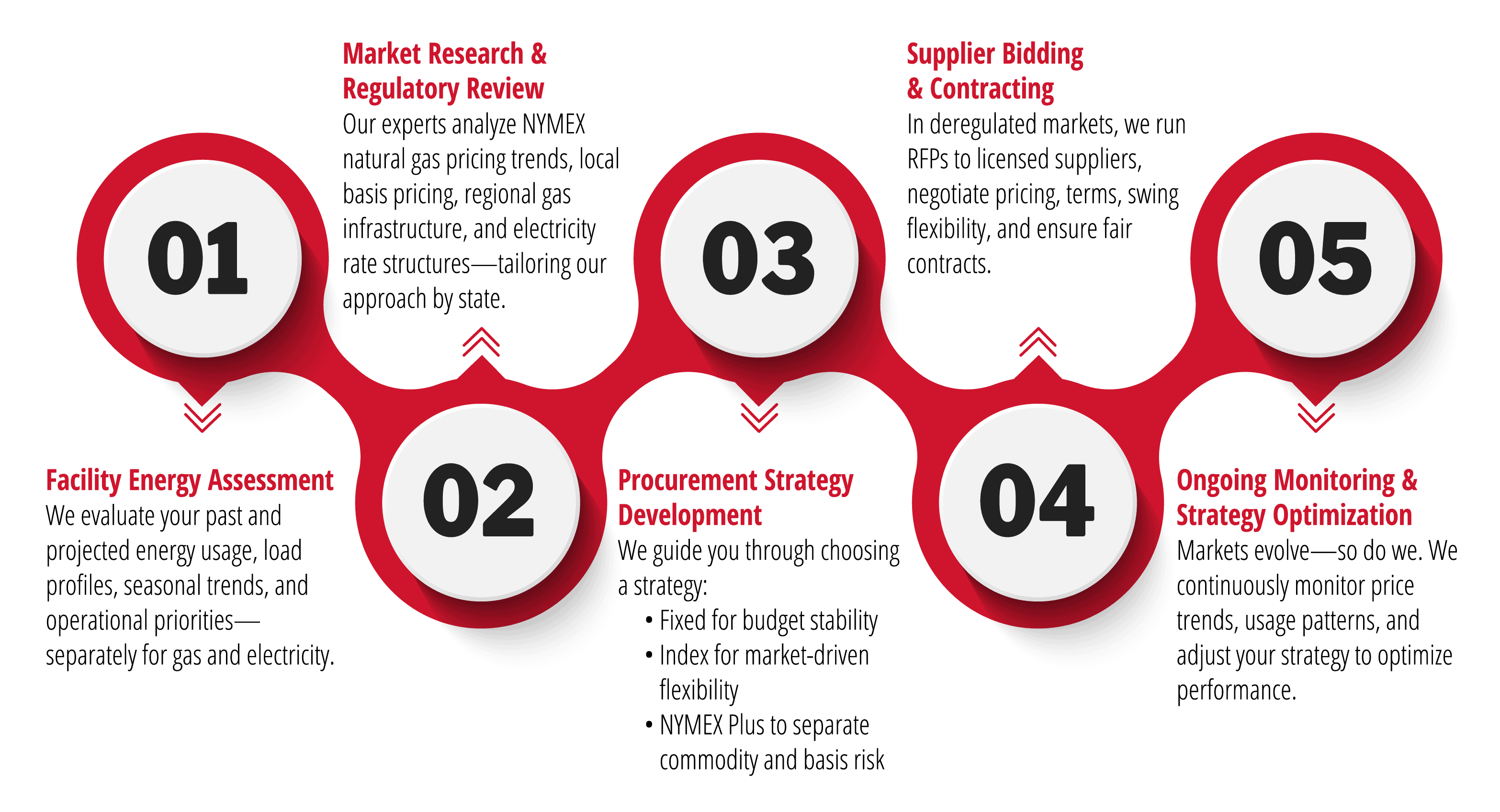

Our 5-Step Energy Procurement Process.

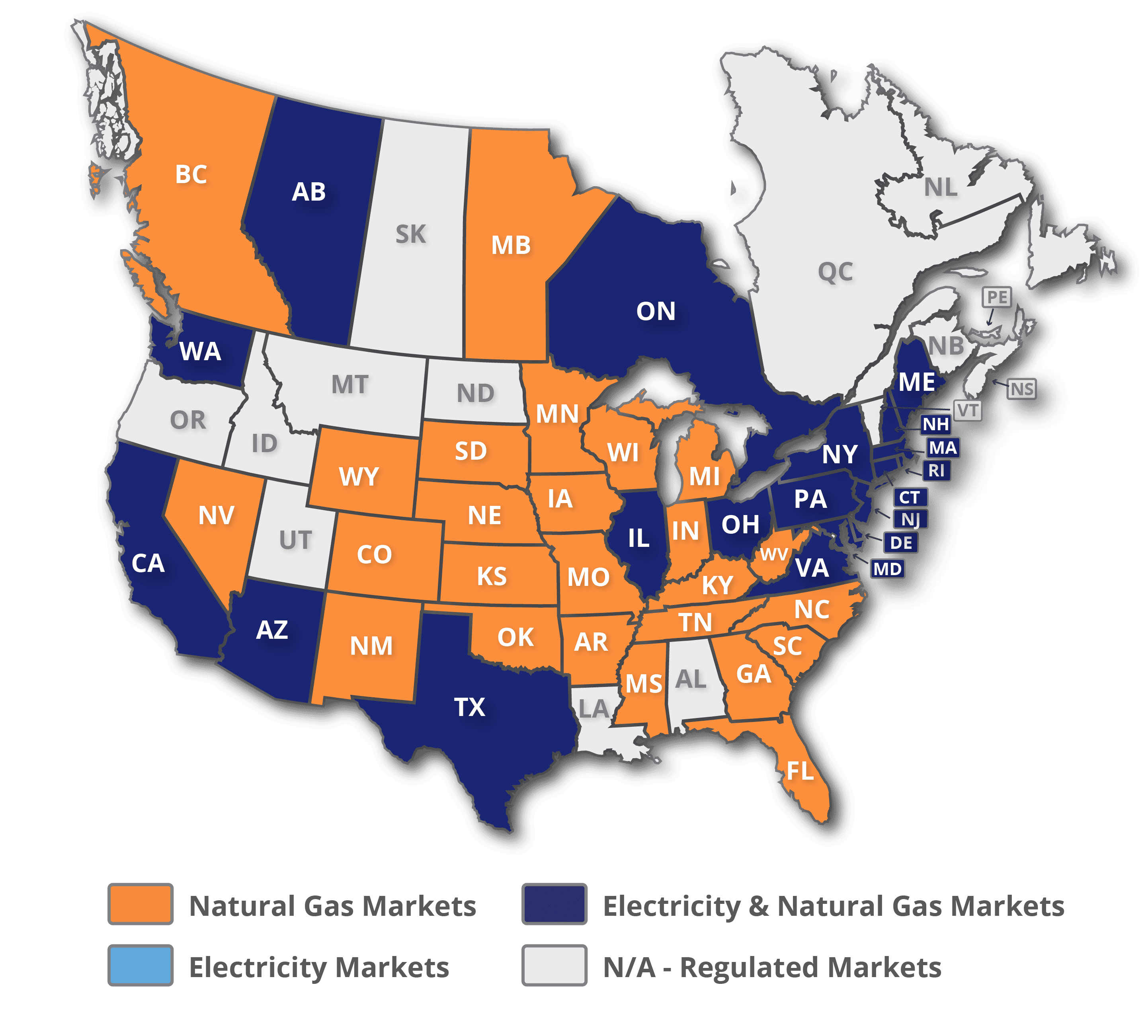

Navigating Deregulated Energy Markets

In deregulated states, businesses can choose their energy suppliers—for both natural gas and electricity. This freedom creates opportunities for cost reduction, risk mitigation, and better service.

We specialize in helping clients make the most of deregulated market benefits.

Deregulated Natural Gas & Electricity States Include:

Widespread Choice:

- Pennsylvania

- Ohio

- Illinois

- New York

- New Jersey

- Massachusetts

- California

Partial/Commercial Choice:

- Texas

- Michigan

- Indiana

- Virginia

- Georgia

- Florida

- Kentucky

- West Virginia

- Colorado

- New Mexico

Procurement Structures We Support

🔸Fixed-Price Contracts

Lock in a price for 6–36 months for budget certainty. Great for gas-heavy operations needing stable costs.

🔸 Index-Based Pricing

Tie your rate to monthly gas indices or electricity tariffs. Allows savings when markets drop—but comes with more risk.

🔸 NYMEX Plus Contracts (for Gas)

Split commodity (NYMEX) and basis costs. Lock one or both depending on market outlook and contract flexibility.

Industries We Serve

We specialize in energy procurement for sectors where fuel and utility costs impact profitability:

Manufacturing

Plastics & Chemicals

Food & Beverage

Automotive & Aerospace

Agriculture & Processing Facilities

Institutional & Commercial Buildings

WHY CHOOSE WASMER?

✔ 20+ Years of Energy Industry Experience

✔ Natural Gas + Electricity Expertise

✔ Mastery of NYMEX & Basis Management

✔ Trusted Supplier Relationships Across States

✔ Transparent Bidding and Contract Support

✔ Proactive Monitoring and Strategic Adjustments

We’re not energy brokers—we’re your long-term procurement partner.

Wasmer also helps you manage:

> Swing provisions: usage flexibility to avoid penalties

> Nominations: contracted volumes vs. usage

> Balancing charges: avoid costly over/under usage fees

With our guidance, these complex terms become clear, manageable, and optimized for your business.

Ready to Lower Your Energy Costs?

Let’s review your gas and electricity bills, assess your current strategy, and show you how Wasmer can unlock savings through smarter procurement.